Key Notes

- Customary Chartered forecasts ETH treasury holdings might attain 10% of complete provide, value $45.5 billion at present market cap.

- ETH-focused treasury corporations gathered 1% of circulating provide in two months, equal to just about $9 billion in holdings.

- Technical evaluation exhibits ETH testing $4,000 resistance with potential breakout to $4,500 if institutional shopping for momentum continues.

Ethereum‘s

ETH

$3 819

24h volatility:

0.8%

Market cap:

$461.14 B

Vol. 24h:

$32.74 B

worth has dipped 4% within the final 24 hours, mirroring the broader crypto market downtrend on Tuesday amid widespread profit-taking. Nevertheless, regardless of the continued ETH worth dip, institutional enchantment continues to accentuate.

According to a recent Decrypt report, Customary Chartered Financial institution’s head of digital belongings analysis, Geoff Kendrick, believes ETH may very well be on the verge of main institutional inflows.

“If the flows can proceed, ETH could possibly break above the important thing $4,000 degree (our present end-2025 forecast),” Kendrick wrote.

His bullish projection is predicated on the commentary that Ethereum treasury accumulation is going on twice as quick as Bitcoin

BTC

$118 171

24h volatility:

0.4%

Market cap:

$2.35 T

Vol. 24h:

$40.04 B

treasury development. If this tempo sustains, Kendrick expects ETH treasury holdings to develop tenfold, reaching 10% of complete provide. With Ethereum’s market cap at the moment trending at $450 billion, a ten% accumulation would see the treasury companies sit on ETH holdings value $45.5 billion.

Notably, within the final two months, ETH-focused treasury corporations have gathered round 1% of your entire circulating provide, in accordance with the Strategic ETH Reserve. At present costs, that’s equal to just about $9 billion in holdings, quickly approaching the two% mark.

The important thing gamers main this institutional ETH cost embody Peter Thiel-backed BitMine, which now holds over $2 billion in ETH, whereas gaming agency, SharpLink, also scooped up another $1.3 billion. This aggressive accumulation is pushed by Ethereum’s staking yields, and potential income enhance from DeFi companies, making upside potential increased than the less-programmable Bitcoin community.

ETH Value Forecast At the moment: Pullback or Breakout Above $4,000?

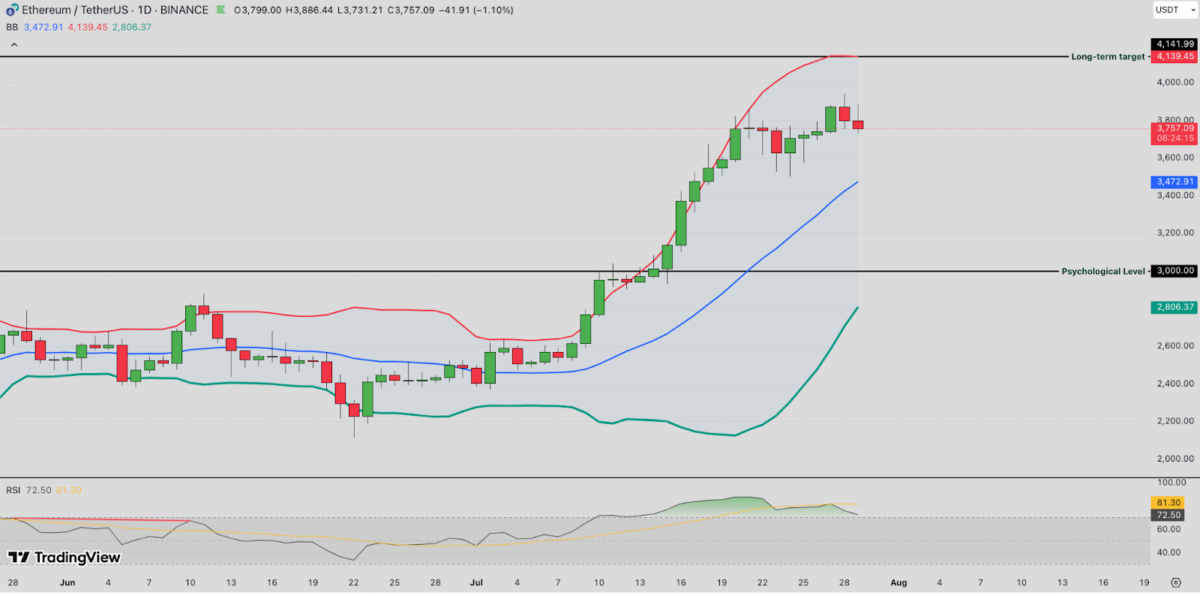

Ethereum is at the moment buying and selling at $3,762, displaying a modest 0.96% every day decline following a rally that examined resistance close to the $4,140 degree, additionally marked because the long-term goal.

Within the upside situation, if ETH rebounds from the present help round $3,700, we might see one other check of the $4,000 resistance. A clear breakout above $4,140 would open the trail to $4,500 within the coming weeks, particularly if treasury shopping for continues.

Ethereum worth forecast | ETHUSDT 24H Chart | July 29, 2025

Nevertheless, if the bearish momentum will increase, Ethereum might retest help ranges at $3,473 (mid-Bollinger Band) and even fall to the psychological $3,000 mark. RSI at the moment sits at 72.90, sloping downwards, suggesting weak shopping for momentum because the market enters overbought situations. Nevertheless, with ETH worth nonetheless holding above the 20-day EMA at $3,472, bulls have a good probability of sparking an early rebound, particularly if momentum builds up round Customary Chartered’s influx predictions.

Finest Pockets Presale Positive aspects Momentum Amid ETH Treasury Increase

As Ethereum attracts main capital inflows from establishments, crypto customers are more and more searching for safe methods to retailer and stake their ETH. One of many options in excessive demand is Finest Pockets, a non-custodial, multi-chain pockets that’s gaining severe traction.

Finest Pockets Presale

At the moment priced at $0.025, the $BEST token powers the Finest Pockets ecosystem, providing early entry to presales, group voting rights, staking rewards, and lowered transaction charges. The presale has already attracted over $14.3 million, a powerful sign of market demand. Go to the official Best Wallet to hitch the presale earlier than the subsequent worth enhance.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed info however shouldn’t be taken as monetary or funding recommendation. Since market situations can change quickly, we encourage you to confirm info by yourself and seek the advice of with an expert earlier than making any selections primarily based on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting varied Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is at the moment finding out for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.