- Bitcoin’s $90 billion pullback remained minor within the face of the macro deleveraging cycle.

- The following leg up might arrive before the market expects.

Contrary to market consensus, Bitcoin’s path to $100k seems more and more possible within the wake of the ‘commerce dump.’

Because the nineteenth of February, the U.S. inventory market has shed $11 trillion in market cap, with 54.55% of that drawdown accelerating post-‘Liberation Day.’

But, this can be just the start. Gold (XAU) marked a Q2 peak at $3,143 per ounce earlier than a close to 3% retracement, erasing $520 billion in market capitalization for the reason that 2nd of April. Bitcoin [BTC], in the meantime, has corrected 5.17% from its $1.74 trillion valuation.

A $90 billion dip is minor in comparison with the broader market flush. Consequently, Bitcoin’s rising divergence from threat belongings and macro swings is reinforcing its long-term positioning.

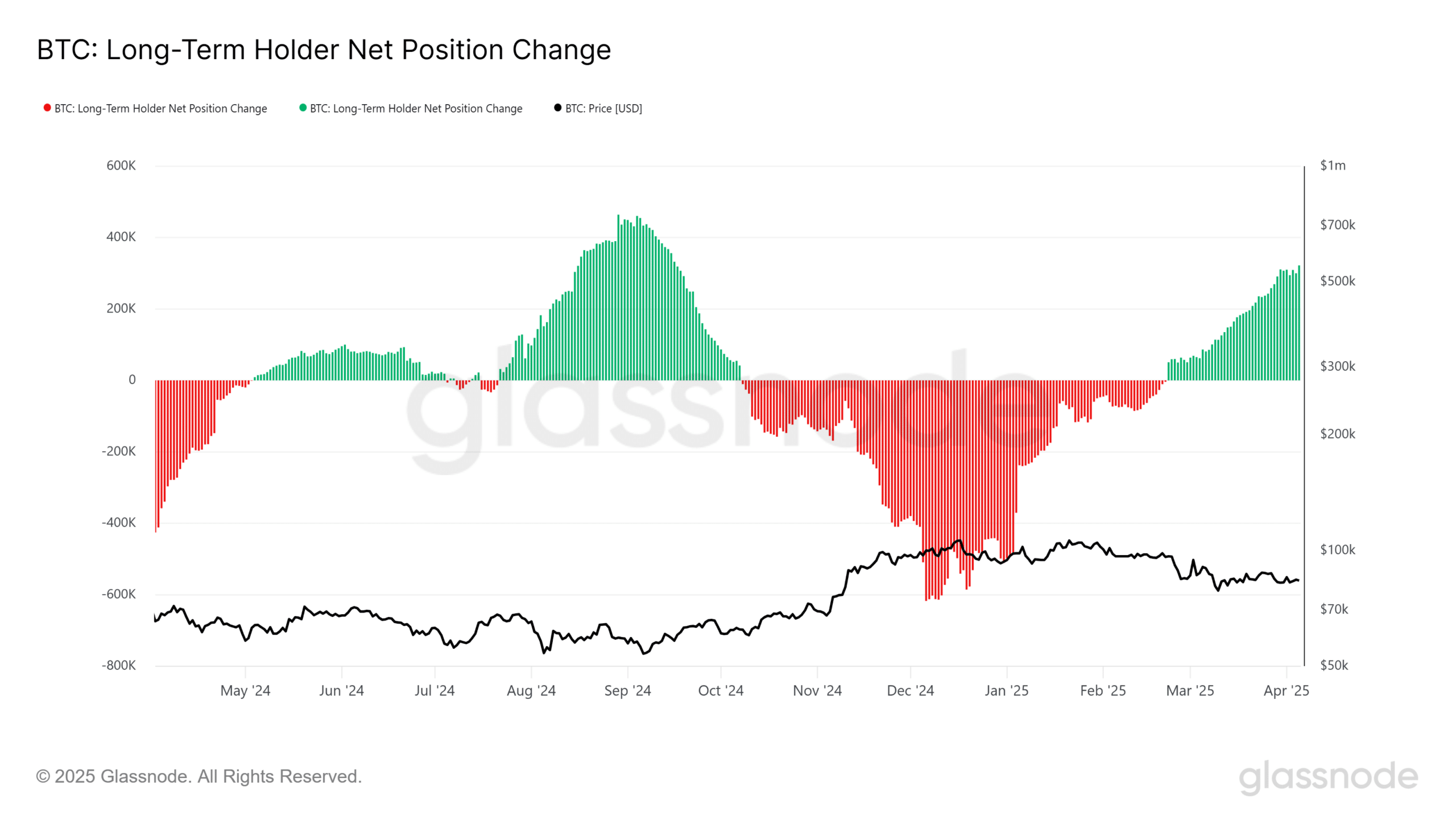

Lengthy-term holders accumulate, reinforcing conviction

Short-term holder supply (<155 days) has declined to a two-month low of three.7 million BTC, reflecting roughly 3 million BTC in realized losses amid Bitcoin’s retracement from its $109k all-time excessive.

Conversely, long-term holder (LTH) provide has expanded over the identical interval.

The Web Place Change metrics sign aggressive accumulation at a median value foundation of $84k per BTC, underscoring sturdy conviction.

At press time, Bitcoin remained capped under $85k, a vital breakeven threshold for weak fingers.

Nevertheless, persistent LTH accumulation and BTC’s widening decoupling from U.S. equities point out a vital inflection level that might set the stage for BTC to reclaim $100k.

The important thing driver? Capital is flowing out of threat belongings – and even protected havens – into BTC.

Germany recently initiated a pullback of 1,200 tonnes of gold price $124 billion from New York reserves. If extra international locations observe go well with, it might weaken Gold’s position as a worldwide haven.

With Bitcoin holding sturdy whereas the S&P500 sheds $4 trillion in every week – the largest drop for the reason that COVID-19 crash – and Gold shedding steam, BTC is in a main place to draw capital from governments, establishments, and retail traders alike.

Bitcoin’s haven standing again in focus

Within the brief time period, to set off FOMO, Bitcoin should break resistance at $85k–$87k, a key zone the place profit-taking intensifies. It’s been a month since these ranges have been final examined.

Due to this fact, establishing a robust bid wall inside this vary is vital for bullish continuation. Nonetheless, a breakdown under $80k stays a low-probability occasion.

Since March 12, whale cohorts (>1K BTC) have aggressively amassed, driving holdings to a three-month-high. With deep-pocketed entities absorbing provide, a retest of the $77k assist seems more and more unlikely.

BTC’s potential to carry sturdy regardless of macro uncertainty retains fueling its case as a hedge in opposition to market turbulence.

So long as demand stays agency, Bitcoin’s path to six-figure value discovery stays well-positioned. Capital inflows might decide up much more, particularly with U.S. shares going through elevated draw back threat from rising tariff pressures.