In keeping with Technique’s official announcement, the corporate added 10,100 Bitcoin to its pile final week. The transfer value $1 billion at a median worth of $104,080 per coin.

Bitcoin slipped from $110,000 on June 9 to a low of $103,550 on June 12 after information of Israel putting Iranian nuclear websites. Technique now holds 592,100 BTC, purchased for about $41.8 billion at a median of $70,666 every.

Rising Bitcoin Holdings

The latest buy is Technique’s second in June. Based mostly on experiences, it brings complete holdings to almost 600,000 BTC. That’s an enormous stash by any measure. The corporate has spent greater than $41 billion thus far. It treats dips as probabilities to purchase extra. The common value per coin stays nicely beneath present market charges.

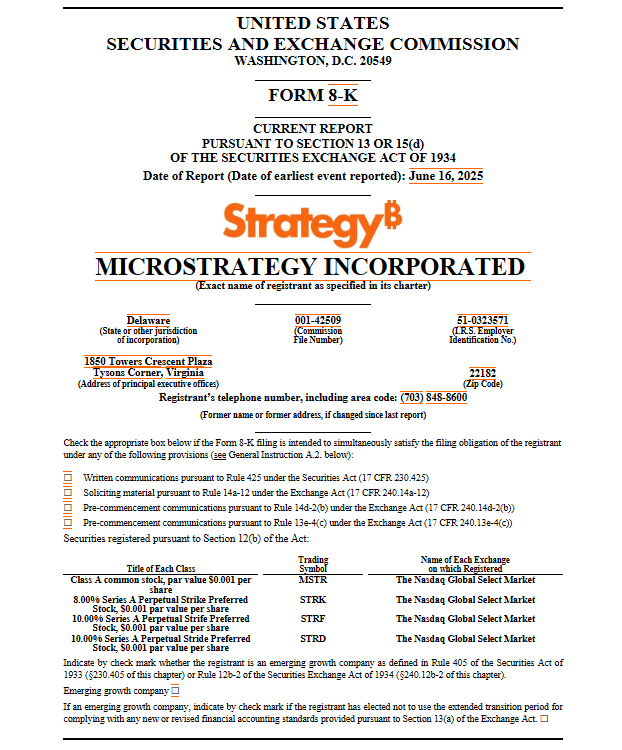

Most popular Inventory Providing

Technique’s new STRD shares started buying and selling on Nasdaq on June 11. The transfer goals to lift $250 million in recent money. In keeping with the corporate, it is going to challenge 2.5 million shares of 10% Sequence A Perpetual Stride Most popular Inventory at $100 every. That money ought to fund extra Bitcoin buys with out tapping its money reserves.

Yield Targets And Progress

Based mostly on Strategy’s data, its 12 months‑to‑date Bitcoin yield now stands at 19.1%. That’s up 2% from final Monday’s 1,045 BTC buy. Quarter‑to‑date yield sits at 7.5%. The agency has upped its purpose from 15% to 25% by December 31, 2025. Hitting that can want robust worth good points over the subsequent 12 months and a half.

Broader Trade Warnings

Saylor has been busy on X, praising friends. He congratulated Metaplanet for reaching 10,000 BTC. He talked about CEO Simon Gerovich and director Dylan LeClair by title. On the identical time, Matthew Sigel of VanEck warned that huge company Bitcoin buys can dilute worth if a inventory trades close to web asset worth. Commonplace Chartered additionally flagged volatility dangers in early June.

The Highway Forward

Technique’s purchase‑the‑dip strategy might repay if Bitcoin climbs and holds above six figures. The popular inventory route offers it dry powder for extra buys. However the 10% dividends on STRD might weigh if good points stall.

Buyers will keep watch over yield updates and any shifts in Bitcoin’s worth swing. For now, Technique is betting on volatility as an opportunity to construct one of many largest company Bitcoin treasuries in historical past.

Featured picture from Cash Instances, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our staff of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.