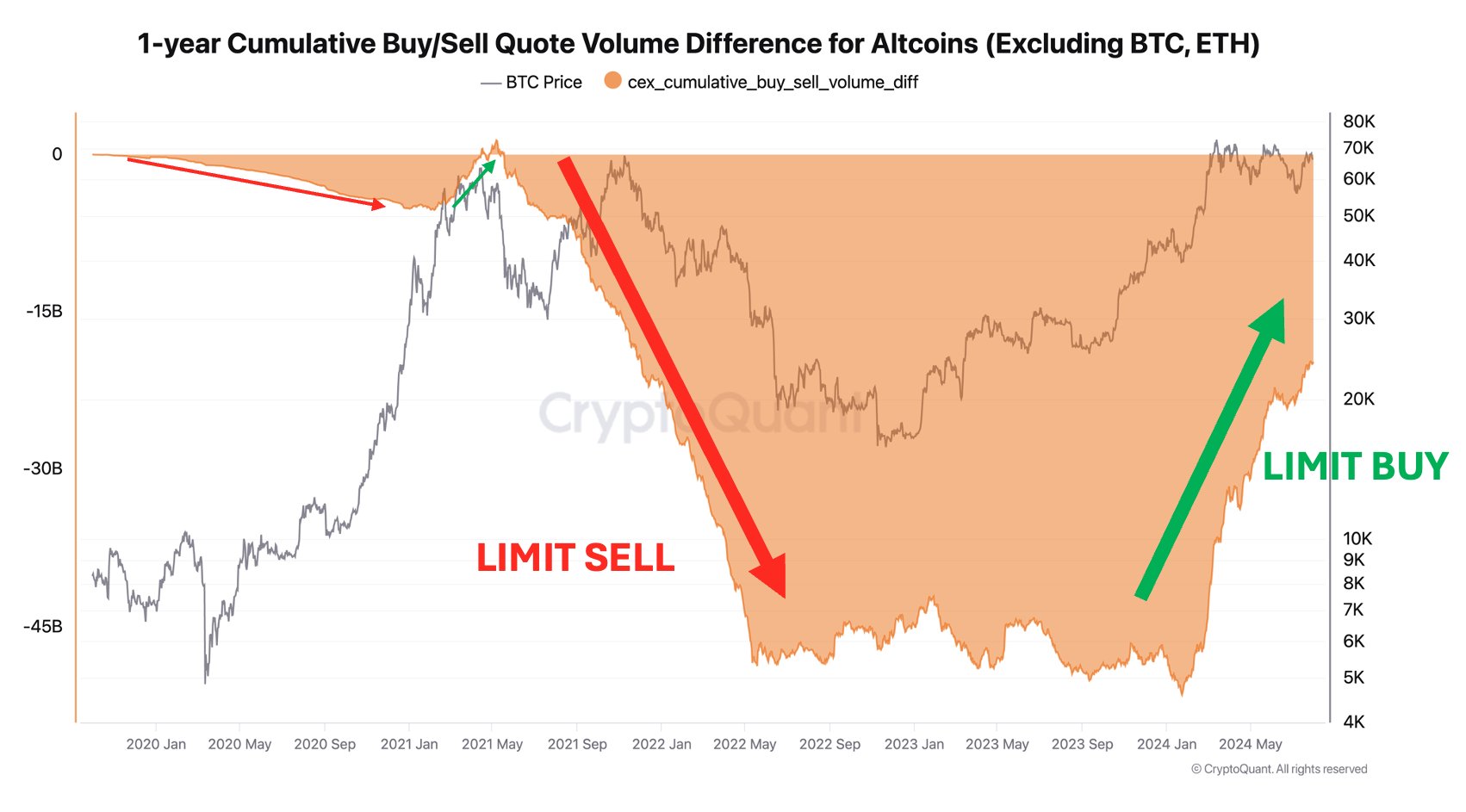

Crypto whales are positioning themselves for the subsequent market enlargement in altcoins, in keeping with the CEO of CryptoQuant.

Ki Younger Ju tells his 358,000 followers on the social media platform X that whales are actually establishing restrict orders for altcoins on centralized exchanges (CEXes).

Ju explains whales, establishments, and different giant entities choose utilizing restrict orders – versus market orders – to keep away from slippage and to get the very best value.

A restrict order is used to purchase an asset at a pre-determined value. It won’t push by till the asset reaches the specified degree. In the meantime, a market order is used to purchase or promote an asset immediately at present costs.

Ju notes that maintaining a tally of the amount of restrict order quotes could be an indicator of rising purchase partitions in the marketplace.

“Whales are getting ready for the subsequent altcoin rally.

Restrict purchase order quantity for altcoins, excluding Bitcoin and Ethereum, is growing, indicating that sturdy purchase partitions are being arrange.”

Ju says time will begin to run out for market members in search of altcoin reductions as soon as Bitcoin (BTC) breaks its all-time excessive (ATH).

“Purchase partitions are forming for altcoins with each stablecoin and Bitcoin pairs, however volumes are nonetheless low.

If alt season means a surge in quantity, it’s not right here but.

Now’s the time to analysis promising alts for the subsequent bull run – time is perhaps brief as soon as Bitcoin hits a brand new ATH.”

In accordance with Ju, Bitcoin’s present state is reminiscent of mid-2020 when it was buying and selling in a sideways method, void of any retail-driven euphoria.

“Bitcoin knowledge resembles mid-2020 sideways.

Older whales switch holdings to newer whales on-chain, however retail buyers haven’t overheated the market but. No vital value surge post-halving.

In my expertise, bull runs are brief however highly effective and sudden. Endurance is vital.”

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Test Price Action

Comply with us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Each day Hodl aren’t funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual danger, and any losses you might incur are your duty. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Each day Hodl an funding advisor. Please word that The Each day Hodl participates in affiliate marketing online.

Generated Picture: DALLE3