Ethereum has cooled after months of robust shopping for stress and bullish momentum, with the market now getting into a consolidation section. Over latest weeks, ETH has traded sideways just under its all-time excessive, leaving buyers unsure in regards to the short-term outlook. Whereas the dearth of follow-through has tempered a few of the optimism seen earlier this 12 months, fundamentals counsel that Ethereum’s place out there stays resilient.

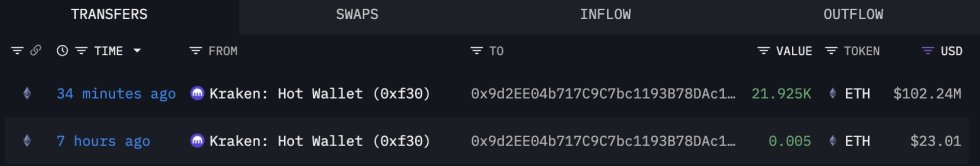

Institutional accumulation continues to be one of many defining themes supporting ETH. Massive-scale withdrawals from exchanges level to a gentle development of buyers shifting cash into long-term storage reasonably than protecting them liquid for buying and selling. In response to Lookonchain, a newly created pockets recognized as “0x9d2E” just lately withdrew 21,925 ETH, valued at $102 million, from Kraken. Such exercise highlights the rising presence of deep-pocketed consumers who’re unfazed by short-term volatility and are as a substitute positioning themselves for Ethereum’s long-term potential.

On the identical time, macroeconomic uncertainty that weighed closely on danger property earlier within the 12 months is starting to dissipate. With establishments stepping in and broader conditions stabilizing, Ethereum’s consolidation could show to be a wholesome reset earlier than its subsequent decisive transfer. The approaching weeks might be essential in figuring out whether or not ETH can break greater or prolong its sideways sample.

Whales Proceed Accumulating Forward of Key Check

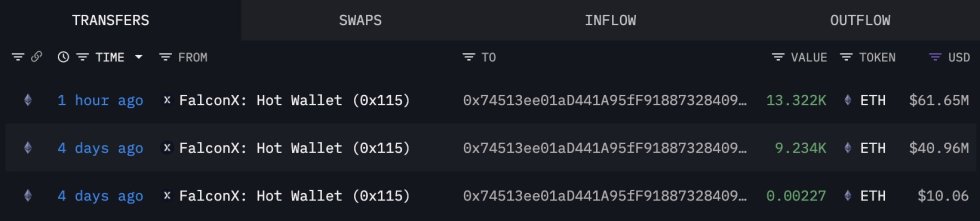

Lookonchain additionally experiences {that a} newly created pockets “0x9D99” just lately withdrew 5,297 ETH, price $24.7 million, from Binance and Bitget mixed. At almost the identical time, one other main participant, pockets “0x7451,” acquired a further 13,322 ETH, valued at $61.65 million, from FalconX. These transactions spotlight the persistence of institutional-scale accumulation at the same time as short-term merchants stay hesitant.

This wave of withdrawals provides to a broader development the place ETH provide on exchanges continues to shrink. As cash transfer into non-public wallets and chilly storage, obtainable liquidity for speedy buying and selling decreases, setting the stage for supply-driven worth stress. Traditionally, intervals of heavy whale accumulation have coincided with consolidation phases that later gave approach to decisive rallies.

The timing is especially important now. Ethereum is buying and selling just under its all-time highs, with market individuals watching carefully for indicators of whether or not the subsequent transfer might be a breakout or an prolonged sideways vary. Whales seem like positioning forward of a possible push into uncharted territory, treating present worth motion as an accumulation alternative.

If Ethereum maintains structural power whereas establishments maintain absorbing provide, the groundwork might be laid for a breakout past prior highs. On the identical time, broader macro situations—together with the Fed’s charge coverage—will seemingly affect the tempo and scale of the subsequent transfer. Regardless, persistent whale shopping for suggests confidence in ETH’s long-term trajectory stays intact.

Value Evaluation: Brief-Time period Pullback In Play

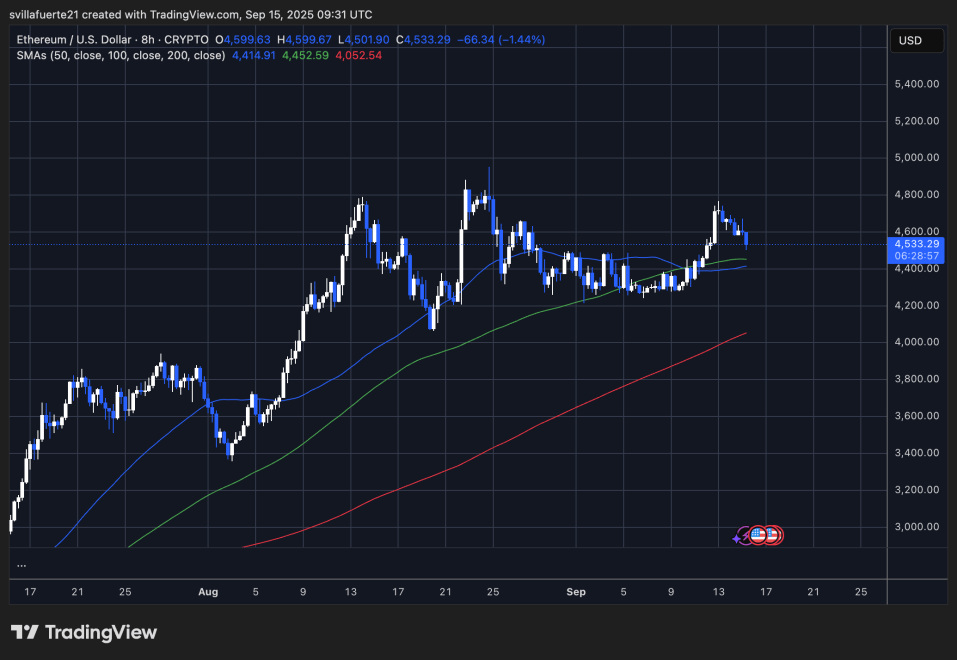

Ethereum (ETH) is presently buying and selling at $4,533, displaying a 1.44% decline after failing to maintain momentum above $4,700. The chart highlights a latest rejection close to the native highs, resulting in a pullback towards short-term shifting averages.

The 50 SMA ($4,414) now serves as speedy assist, carefully aligned with the 100 SMA ($4,452). This cluster of shifting averages is essential, as holding above it might stabilize ETH and forestall a deeper draw back. A breakdown beneath this zone would open the door for a retest of the 200 SMA at $4,052, a stage that has traditionally supplied robust assist throughout consolidations.

On the upside, Ethereum faces resistance close to the $4,700–$4,750 vary, which has capped worth advances over the previous few classes. A decisive shut above this stage would seemingly set off a push towards the $4,900–$5,000 zone, placing ETH nearer to retesting its all-time highs.

For now, ETH stays in consolidation mode, buying and selling sideways inside a broader bullish construction. Institutional accumulation and shrinking trade balances proceed to assist the long-term outlook, however short-term volatility might persist. So long as ETH holds above $4,400, the setup favors consumers, with potential for renewed upward acceleration as soon as momentum returns.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.