- BTC’s latest rally might stall amidst rising promote strain, as per Coinbase analysts

- QCP Capital and Coinbase analysts projected a range-breakout in This autumn 2024

On Friday, Bitcoin [BTC] climbed increased on the charts and hit a month-to-month excessive of $67.3k, regardless of an total meltdown throughout U.S equities.

Nevertheless, Coinbase analysts have a phrase of warning to share. In keeping with them, the latest good points might entice profit-making and “restrict worth transfer to the upside.”

In actual fact, a part of the trade’s weekly market commentary read,

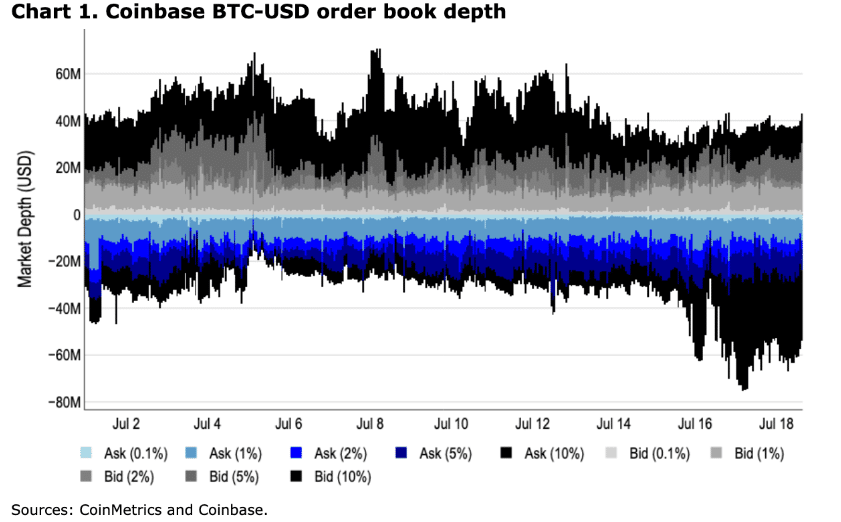

‘We now have seen a rise within the quantity of complete promote orders positioned inside 5-10% of the mid worth. That implies that we could also be seeing some revenue taking at present ranges and/or a better willingness by market members to promote into worth appreciation’

For perspective, market depth tracks the quantity of promote (ask) and purchase (bid) orders. Constructive values in USD denote purchase orders, whereas unfavourable values monitor promote orders.

The hooked up Coinbase chart revealed a major drop in market depth between 16 -18 July, with growing asks (promote orders). Within the short-term, this might put extra downward strain on the cryptocurrency’s worth.

Extra Bitcoin promote volumes

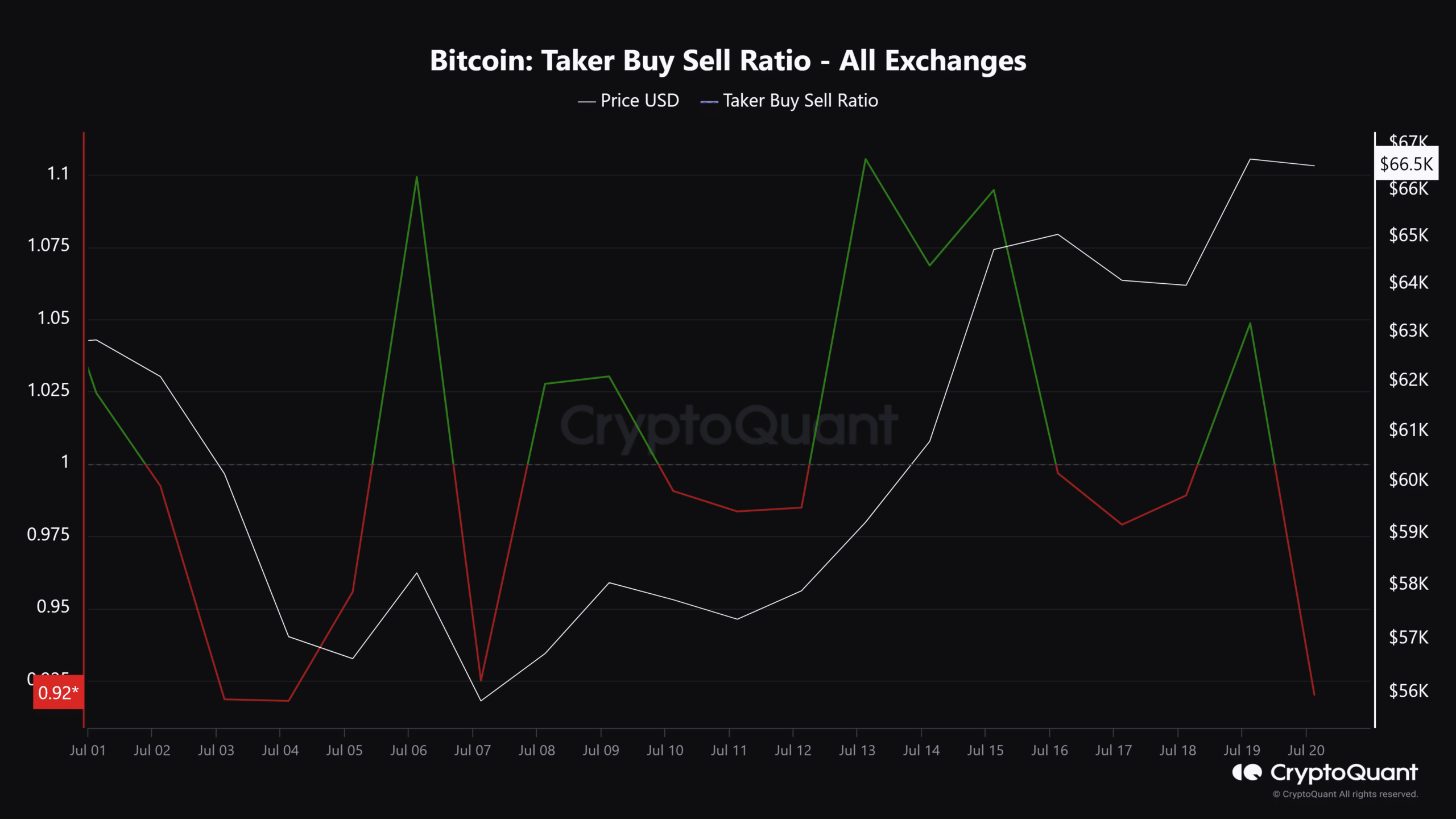

The aforementioned pattern was additionally recorded throughout most exchanges, particularly on the derivatives aspect. As per CryptoQuant’s information, as an example, promote volumes eclipsed purchase volumes on Saturday, as proven by the declining Taker Purchase Promote Ratio.

This metric, which divides purchase volumes by promote volumes, signaled bearish sentiment at press time after dropping under 1 on the charts.

In the meantime, Coinbase analysts consider that the seemingly profit-taking throughout the latest rally match nicely with its uneven and vary buying and selling forecast for Q3 2024. Nevertheless, additionally they consider {that a} rally continues to be possible in This autumn of 2024.

This forecast is in keeping with that of QCP Capital’s analysts too. In a Friday notice to its Telegram group, QCP Capital analysts noted,

“Whereas spot might vary right here within the close to time period, particularly with sellers very lengthy the 26-Jul 67k Strike, the market is unquestionably betting large on a breakout heading into the US elections.”

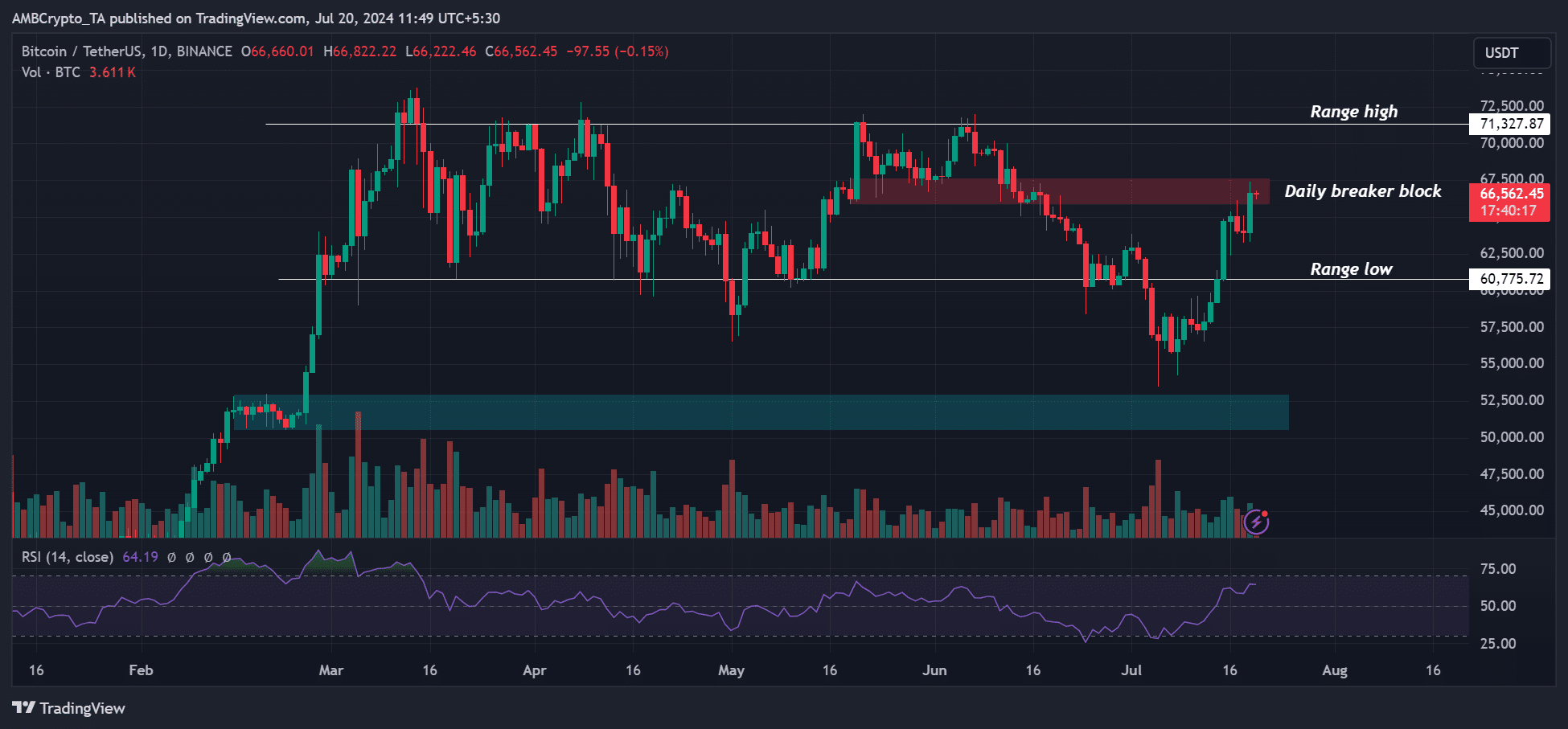

On the worth entrance, at press time, the cryptocurrency was but to mount above the impediment and every day breaker block, marked pink, close to $67.5k.

If bulls clear this hurdle, a swift retest of the range-highs at $71k could be seemingly.