Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

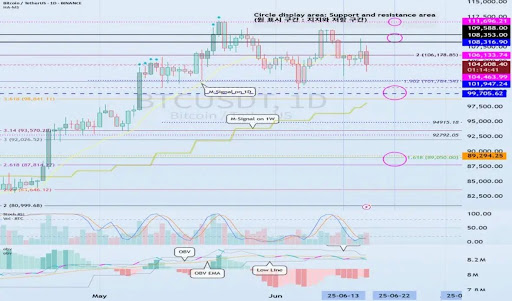

The Bitcoin price action is at the moment testing buyers’ nerves because it hovers round $100,000. Whereas it flirts with this psychological level, analysts are highlighting June 22, 2025, as a key date for potential volatility. Backed by each historic volatility patterns and technical indicators, this date is gearing as much as be a important window for Bitcoin’s subsequent transfer.

Bitcoin Worth Braces For Volatility On June 22

Bitcoin is coming into a decisive section because it trades above the $100,000 mark, with technical indicators identified by TradingView knowledgeable ‘readCrypto’ aligning round a important timeframe—-June 22. The chart evaluation reveals that June 22 is a crucial date, signaling the projected begin of Bitcoin’s next volatility window, with a possible to interrupt out or break down relying on how the flagship cryptocurrency reacts to key assist and resistance zones.

Associated Studying

Presently, Bitcoin is buying and selling at $104,731, near a pivotal confluence vary between $104,463 and $106,133—a zone highlighted as a structural mid-point. This space is outlined by the DOM (60) and a Heikin-Ashi excessive level on the worth chart, marking the formation of a current higher boundary. Furthermore, the decrease finish of the vary sits round $99,705, which is the HA-Excessive assist stage, the place the worth has beforehand been examined however not but damaged.

In keeping with the analyst, the June 22 date is vital as a result of it coincides with the confluence of key value ranges with the M-Sign indicator on the weekly chart. This indicator is at the moment rising and aligning close to the $99,705 HA-high stage. If Bitcoin falls under this stage, it might sign the beginning of a deeper corrective move, presumably towards the month-to-month M-Sign line and even the $89,294 area, corresponding with the two.618 Fibonacci.

Conversely, if Bitcoin holds above this stage and breaks out of the $108,316 resistance, momentum might shift again to the upside. The analyst has set upper bullish targets close to $109,598 and $111,696, reflecting the ultimate resistance zone earlier than new highs.

Help Zones And Momentum Point out Tense Standoff

Shifting previous readCrypto’s volatility-driven projection, the TradingView analyst’s Bitcoin chart reveals that the On-Stability-Quantity (OBV) oscillator stays under the zero line. This means that regardless of current good points, selling pressure may still be dominating the broader market. Nonetheless, the histogram within the chart reveals indicators of waning momentum on the promote aspect.

Associated Studying

This divergence aligns with Bitcoin’s weakening Stochastic Relative Strength Index (RSI), which signifies momentum could also be cooling. The low OBV readings, mixed with the current bounce from a decrease assist vary, additionally underscore an intense standoff throughout the market. If Bitcoin breaks under the Heikin Ashi excessive level at $99,705, a retest of recent lows at $89,294 is greater than possible.

Till then, readCrypto’s evaluation reveals that each one eyes are on the $104,000 to $106,000 zone. The world between $99,705 and $108,316 now defines the high-boundary consolidation vary. A confirmed transfer outdoors this vary, primarily triggered throughout the June 21-13 window, might dictate Bitcoin’s next major move.

Featured picture from Pixabay, chart from Tradingview.com