Bitcoin has extended its consolidation below $100,000 because the starting of February. This worth lag has been compounded by a slowdown in bullish sentiment amongst traders and a slowing euphoria relating to the crypto-positive influences of Trump’s new administration within the US.

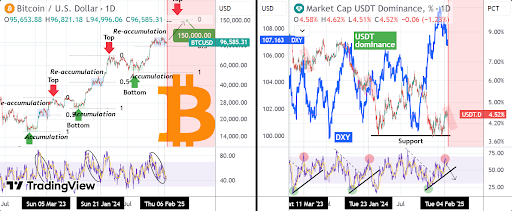

Regardless of this rally slowdown, technical evaluation continues to assist a bullish long-term outlook for Bitcoin. The present stagnation seems to be a re-accumulation part for bullish traders; a sample noticed a number of instances earlier than main upward strikes this cycle. Moreover, evaluation exhibits that the USDT dominance goes to play an important function in triggering the subsequent Bitcoin rally towards $150,000.

Bitcoin’s Re-Accumulation Part And The Function Of USDT Dominance

In line with a technical analyst (TradingShot) on the TradingView platform, Bitcoin is at the moment exhibiting an attention-grabbing accumulation development alongside the USDT dominance. The USDT dominance displays the share of the entire crypto market capitalization in USDT, indicating whether or not merchants favor stablecoins over riskier crypto belongings. A excessive USDT dominance usually alerts low shopping for stress in cryptocurrencies. Conversely, a declining USDT dominance typically means that merchants are rotating funds again into Bitcoin and different cryptocurrencies.

Associated Studying

Curiously, the USDT dominance has had an important simultaneous prevalence with Bitcoin’s preparations for rallies this cycle. Two notable re-accumulation durations have occurred after Bitcoin bottomed in November 2022, with every resulting in vital worth rallies. The primary accumulation interval spanned from January 2023 to March 2023, whereas the second occurred between November 2023 and February 2024. Each of those re-accumulation phases happened on the 0.5 Fibonacci extension stage from an earlier accumulation part. Moreover, these phases shared widespread traits, together with a peaking 1-day RSI construction within the USDT dominance chart and a pullback within the Greenback Index (DXY).

Now, Bitcoin seems to be mirroring the same conditions once more, with USDT dominance and the DXY pulling again with the present re-accumulation part, which has been enjoying out since December 2024. If the sample continues to unfold as expected, this might point out that Bitcoin is on the verge of its subsequent main rally.

USDT To Ship BTC To $150,000

If Bitcoin follows the sample noticed in earlier rallies this cycle with the USDT dominance to the core, the re-accumulation part might finish within the next one or two weeks and finally trigger one other rally to new all-time highs.

Associated Studying

When it comes to a goal, the analyst famous a possible $150,000 goal for the Bitcoin worth, at the least earlier than one other main correction and a subsequent accumulation part. Nonetheless, Bitcoin should overcome key resistance levels, significantly the psychological $100,000 mark, which has served as a significant hurdle in current weeks.

On the time of writing, Bitcoin is buying and selling at $97,175, up by 1.6% previously 24 hours. A transfer to $150,000 will symbolize a 54% improve from the present worth.

Featured picture from Pexels, chart from Tradingview.com